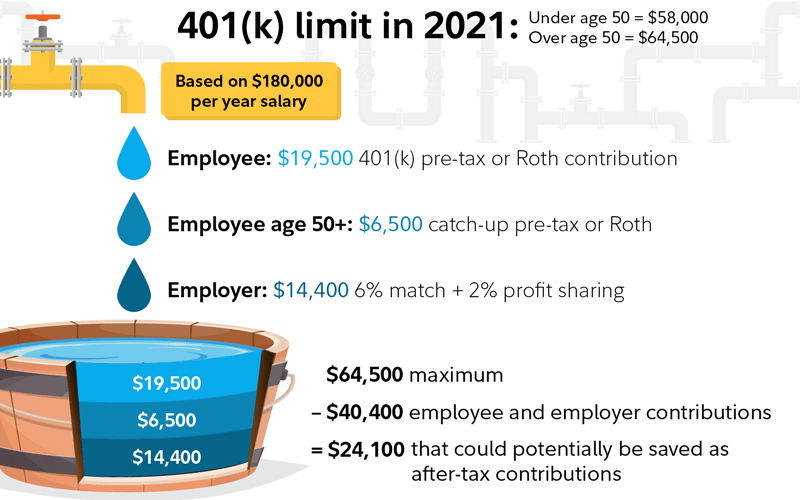

2025 401K Catch Up 2025 2035 2045. 25, 2023 — today, the irs announced an administrative transition period that extends until 2026 the new. Workers ages 50 and older have a higher annual 401 (k) contribution limit than their younger peers.

2025 401K Catch Up 2025 2035 2045 Workers ages 50 and older have a higher annual 401 (k) contribution limit than their younger peers. 25, 2023 — today, the irs announced an administrative transition period that extends until 2026 the new. $10,000 or 50% more than (or 1.5 times).

Workers ages 50 and older have a higher annual 401 (k) contribution limit than their younger peers. $10,000 or 50% more than (or 1.5 times).

$10,000 Or 50% More Than (Or 1.5 Times).

25, 2023 — today, the irs announced an administrative transition period that extends until 2026 the new. Workers ages 50 and older have a higher annual 401 (k) contribution limit than their younger peers.